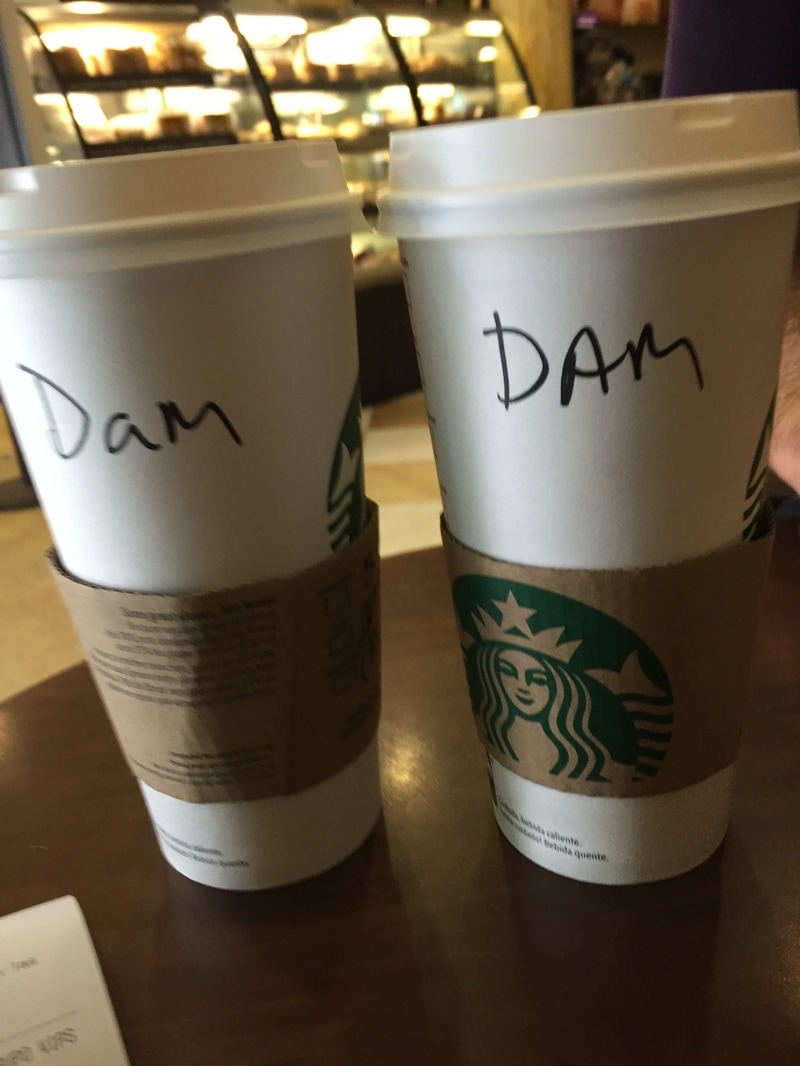

Dam, that's expensive Dam, that's expensive There are a million parallels between money and body weight (and clutter, when it comes to that). Anything we learn about one usually works as a useful thinking tool for the other. One of these tools is to use our metrics to calculate a trend line, using our past behavior to predict our future results. When we want to take better care of Future Self, it is helpful to evaluate by the month, not the day. Why by the month and not the week? Most of our bills occur monthly. Rent or mortgage, car payment, student loan, electric bill, gym, internet, cable, storage unit, phone bill, all that stuff shows up monthly. We can break down our quarterly or annual bills, like car insurance or roadside assistance, and plug in a monthly cost for these as well. It gets tricky when we have to work out an estimate for our variable weekly and daily expenses over a month, because we usually don't like the answer. I think some of this attitude comes from having an allowance as a child. We want to feel like we can have fun with as much of our money as possible. We work so hard and we're so tired so much of the time, and we have to drive in traffic and follow a dress code... surely we're entitled to splurge and have a treat from time to time? This is all well and good for Present Self, but not very kind to Future Me. We don't realize how much we're sacrificing to preserve that sense of fun and freedom.

The emotional comfort of having "enough" savings is something I wish I could bottle, so people could get spritzed and have a whiff. One waft of that fragrance would be a major motivating force. There is such a huge psychic difference between having a major, unexpected expense with no savings, or having a savings cushion and then having an extended run of good luck. It starts when you realize that you already have enough in your checking account to pay all of your rent and bills this month and next month, with some left over. There's always something. I personally have been laid off, had major medical expenses while uninsured, received erroneous tax bills, been billed for equipment I had already returned, had engine failure on road trips (more than once), had the primary vehicle die, and I don't even want to talk about how many veterinary emergencies. There is a guarantee for expensive disasters that is much stronger than the guarantee of finding cute shoes or a "can't miss" sale. It feels so unfair and boring, when what we want to feel when we spend money is the internal fireworks of delight and dopamine. The trouble is that spending money in search of that fun, exciting feeling doesn't always deliver the desired emotional payoff. That's true even today. Then there's the deferred sinking feeling of dread when we realize we've been overspending. We never see it coming, because the last thing most of us are going to do with our free time is to estimate our monthly spending on a graph. I know exactly how I would do it. I'd start out with a $5 green tea soy latte and a $3 pastry, plus tip. Then I'd have an $18 lunch, sometimes more because I really should be eating more salads. Then I'd do a little shopping and spend $70 on books, plus tax, and maybe a new top. Ooh, I'm so busy, better text my honey and convince him to take a Lyft over to meet me for sushi and a movie! I could happily spend every day like this, much less spreading it over a week or two. It would feel so natural and easy, I wouldn't even realize that my burn rate was roughly $200 (a week? A day?), not including rent, utilities, vacations, gifts, debt maintenance, or special occasions. My daily splurges almost automatically become routine daily requirements. Then I'm chasing my tail, trying harder and harder to get that feeling of luxury and sparkle. I feel deprived when I have to "skip" what I can't afford in the first place. This is why scarcity mindset is so much more expensive than abundance mindset. Planning for the future is a gift to myself. It takes imagination, especially because most people don't bother to do it, but I can get emotional juice out of putting money aside for Future Me: Next Year and Future Me: Age 60 and Future Me: Age 80 and Future Me: Who Even Knows. It also takes imagination to find comfort and excitement in the routine. There is no specific price tag on a sense of abundance, just as there is no upper limit to the amount that still will not satisfy a sense of deprivation. I can be cheerful eating homemade lentil soup, and bored and resentful at a five-star restaurant. I can sit with the realization that none of the tinsel and glitter I see are really going to satisfy me the way the actors in the commercial look satisfied. Nothing I have ever bought has ever made me jump into the air with my knees four feet off the ground and my arms in the air, I can say that much for sure. Extrapolating my habitual activities over a month prevents me from fooling myself about "unusual" days or weeks. It's harder to write off my behavior as anomalous or claim it doesn't count for some reason. All the birthday cake and candy I had this month counts, just as I probably don't eat broccoli or cabbage as often as I mentally tally it. All the trinkets and treats I buy count, just as all my unfair bills and fines do, and I probably don't save money at nearly the rate I'd like to believe. I'm just trying to live in reality, to understand my own proclivities, and to make sure I'm really living up to my own standards and preferences. An underrated advantage of estimating our monthly expenses is that it enables us to estimate our annual expenses. The reason we do this is that we can then estimate how much we would need to maintain our current lifestyle if we were financially independent. What seems impossible today can, with sufficient data, seem nearly inevitable four or ten or fifteen years down the road. Extrapolating into the future induces optimism. Comments are closed.

|

AuthorI've been working with chronic disorganization, squalor, and hoarding for over 20 years. I'm also a marathon runner who was diagnosed with fibromyalgia and thyroid disease 17 years ago. This website uses marketing and tracking technologies. Opting out of this will opt you out of all cookies, except for those needed to run the website. Note that some products may not work as well without tracking cookies. Opt Out of CookiesArchives

January 2022

Categories

All

|

RSS Feed

RSS Feed