|

One percent? One percent of what? How can one percent possibly make a difference?

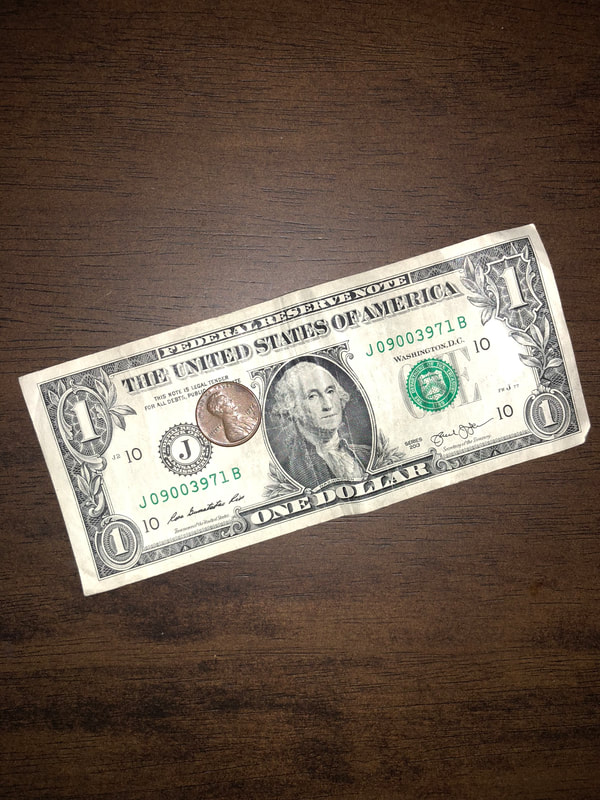

What we’re talking about is the simplest way to start getting a handle on your finances when you feel like everything is impossible. Hopeless! It’s hopeless! It’s not hopeless. The way I started running in my thirties was that I visualized adding one sidewalk square per day. I was sure that no matter how tired I felt, I could always make myself trudge along another couple of feet. One sidewalk square was a measurement I could visualize and understand. It worked; I never realized on that first day that I’d wind up running a marathon four years later. In fact, if I’d thought of that kind of distance, I would have quit before I began, because it just sounded like too much. That’s why we’re starting with one percent, because it’s small. That’s one penny out of a dollar. A dime out of ten dollars. Little by little, though, it adds up. Also, it teaches us to think of large amounts in small, manageable chunks. When my husband and I first met, we bonded over our finances. I was fresh out of college, and my student loans literally got bigger every time I made a payment. He had only been divorced for a year, and he wasn’t very far into the alimony and child support process. We were both broke. We also both enjoyed talking about the intricacies of finance. That’s why it surprised me so much when he shared that he wasn’t contributing to his retirement. “WHAAAAAAT?!?” I squawked. He vented a bit about the alimony, child support, basically paying for two households. I wasn’t about to hear it. I reminded him that I earned barely over a quarter what he did, but I was maxing out my retirement contributions. After paying my rent, student loan, and car payment, I barely had enough left for groceries. “You can’t even save one percent? I don’t buy it.” He retorted that I had “small money problems” while he had “big money problems.” Later, he confessed that he’d thought about what I said, and he went into HR and filled out the forms to start saving toward his retirement again. I feel pretty smart about this now, considering that we eventually got married! We weren’t even dating at that time, but the tens of thousands of extra dollars he saved because of my rude lecture are now growing nicely. That conversation is also part of why we got married. Frugality that comes naturally to me is highly attractive to my spouse as well. At that time in my life, I picked up coins in the street (still do) and I would deposit them into my checking account along with my paycheck every week. Maybe thirteen cents here and forty cents there. This paid off several months later, when I got hired permanently and had to wait three weeks between checks. I overdrew my account by eleven cents, and because of my habit of going into the bank in person every week, I talked my favorite teller into waiving a $22 overdraft fee. If that overdraft were a few dollars more, maybe that negotiation wouldn’t have gone in my favor. Too bad I didn’t find an extra quarter one day. I kept a spreadsheet in those days. It was the only thing that helped me feel like I had any control over my situation. I would have roughly thirty dollars left at the end of the MONTH. I was using credit cards just to buy food, and just as I’d pay off the balance on one card, I’d run it up on the other. The best I felt that I could do was to get the total balance a few dollars lower every month. I set my sights on getting hired permanently from my temp assignment, on promotions and raises. In the meantime, I made a little here and there. I sold a few things on eBay, my roommate and I had a yard sale, I joined her when she got a table at the flea market. I cleaned houses and babysat just like I always had. I beat down those credit cards little by little. I didn’t buy things. When I say that I didn’t buy things, I mean that I didn’t buy things! I wore the same outfits over and over and over again. I had two casual sweaters to wear on winter weekends. They drove me crazy, and I felt like burning them in the parking lot by the time I could finally afford to replace them. I went to the public library and brought home books and DVDs. Sometimes I just went to bed early. I worked overtime, sometimes clocking in early and staying late on the same day because it was that kind of job. The thing about starting with one percent is that it forces you to get out a calculator if you want to do it right. You have to start getting more specific about real quantities and real dollar amounts. It’s just a way of being honest with yourself and the world. It’s a way of making sure you don’t make any commitments you can’t keep. It’s a way of protecting Future You from having a worse situation than you do today. At least when you’re treading water, you’re not going under. Starting with one percent means you’ve made a decision. It means you’re going to get more serious about your finances. It means you’re going to pay attention to your income and your expenses. It means you’re willing to adjust how you spend your time and energy to free up more cash flow toward your savings and debt repayment. It means you’re not allowing any more blind spots in your behavior. Starting with one percent is a start. Maybe it’s only one penny out of every dollar. That’s okay. It’s also one dollar out of every hundred! When you’re used to it, you can stretch a little and make that one percent into two percent. That sense of manageable amounts is what you can use to go as far as you like. Comments are closed.

|

AuthorI've been working with chronic disorganization, squalor, and hoarding for over 20 years. I'm also a marathon runner who was diagnosed with fibromyalgia and thyroid disease 17 years ago. This website uses marketing and tracking technologies. Opting out of this will opt you out of all cookies, except for those needed to run the website. Note that some products may not work as well without tracking cookies. Opt Out of CookiesArchives

January 2022

Categories

All

|

RSS Feed

RSS Feed