|

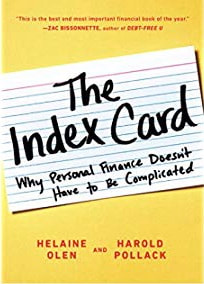

The Index Card is an idea that needs to catch on. Helaine Olen and Harold Pollack believe that personal finance should be simple enough to explain on an index card. The same could or should be true about other things, like parenting, nutrition, fitness, or staying married. Why? Because when these things seem complicated and difficult to understand, they set us up for pain and heartbreak. When they seem simple and approachable, we’re able to handle them well, and life is so much easier. Let’s see how we can use this index card method to simplify our finances.

The authors of The Index Card are highly skeptical of the finance industry. They lead with the example of a man who asked how to invest a chunk of money, and every professional he spoke to gave him completely different advice. (Would that have been true of a series of car mechanics or construction contractors?) How is an average person supposed to make sense out of that? The authors met because Helaine wrote a book about the finance industry, and Harold asked to interview her for his blog. His family had serious financial issues to overcome after his wife’s disabled brother came to live with them. Thus, The Index Card is based on both industry knowledge and practical personal experience. According to the book, and validating our suspicions, most people have money problems. A third of households have a bill turned over to collections every year. Almost half of Americans keep a balance on their credit cards. The majority of retirees leave the workforce earlier than they planned. Most people aren’t set up to handle an emergency. Certainly a bit more financial knowledge would be helpful in this area that so many find stressful, confusing, and disappointing. The Index Card points out that older generations may have claimed to have stronger values about frugality and money management, when in reality they had virtually no access to credit. The financial industry of their time bore almost no resemblance to what exists today. We’re able to get into all new kinds of financial trouble. This book has straightforward advice on navigating investment products and interviewing financial advisors. It also has some basic advice on saving money on food and various other services. Personally, I follow some of the advice on this legendary index card, but not all of it. For instance, it says to save 20% of your income, and my husband and I save 40%. There are people in the FIRE community who save significantly more; a lot of couples both work full-time and bank one entire income plus part of the other. I’ll admit as well that I own several individual securities, that it has worked quite well for me so far, that I have occasionally beat the market, and that I broke even in 2008. Listen to Olen and Pollack, though; most people don’t have the time or inclination to do the amount of research that I did. Also, the game ain’t over yet. I may be crying in my tea by the time I officially retire. Favorite quotes: We feel as if we are falling behind because, frankly, we are, often through no fault of our own. If we all need to be wary of the financial services industry, and yet we also need to be proactive about our finances, what do we do? Don’t count on working forever. Comments are closed.

|

AuthorI've been working with chronic disorganization, squalor, and hoarding for over 20 years. I'm also a marathon runner who was diagnosed with fibromyalgia and thyroid disease 17 years ago. This website uses marketing and tracking technologies. Opting out of this will opt you out of all cookies, except for those needed to run the website. Note that some products may not work as well without tracking cookies. Opt Out of CookiesArchives

January 2022

Categories

All

|

RSS Feed

RSS Feed