|

Interesting things always happen when you clear clutter, and this was no exception. My husband was going through a bag of papers, the last thing left from our move six months ago. Yes, a bag, a reusable shopping bag. Aha, he said, here it is! We’d been looking for this. The first financial plan we ever put in writing together.

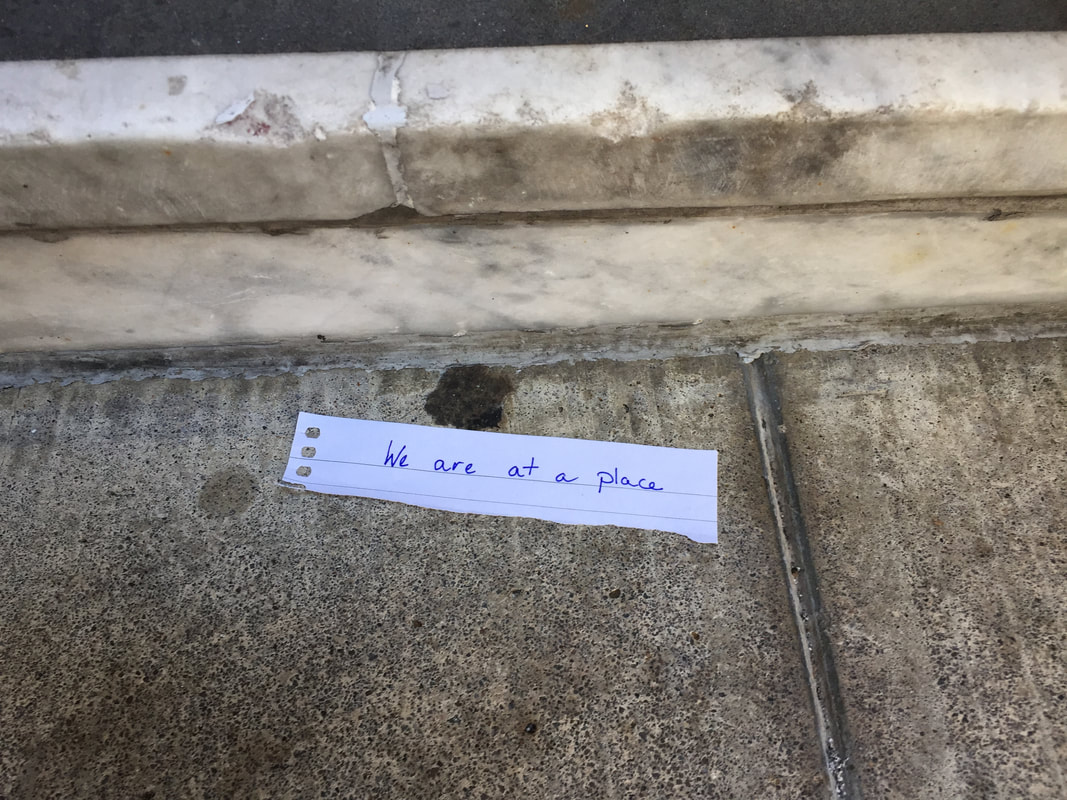

In 2009, we made a ten-year financial plan. It turned up just as we were getting ready to do our taxes for the tenth year. How’d we do? Before I answer that, I should explain what is so significant about this ten-year plan and why anyone other than us would care about it. What I didn’t know that winter was that my boyfriend at the time had already decided he wanted to marry me. We had been dating for nearly three years, living in separate cities the whole time, and I was perfectly fine with this arrangement. We had both been divorced, mine five years before his, and I didn’t see any reason to disrupt what we had. I also felt like it was his decision if he ever wanted to get married again, because his divorce was much fresher and he had a kid. There was nothing to be gained from exerting any pressure on my end, especially because I value my independence and I need a lot of alone time. I had steadily been doing better for myself and I was proud of my progress. Keep in mind that when we met, I was sleeping on an air mattress in a rented room, working as a temp, with no benefits. After I paid my student loan every month, I had about $30 of wiggle room in my budget. This boyfriend of mine, the one who was secretly contemplating marriage, had watched me as I consolidated my position: The first raise. The permanent job offer, with benefits and another raise. The first promotion. Moving to an apartment of my own, with no roommates. Paying off two credit cards. Paying off a student loan six years early. Applying for, and getting, two promotional opportunities. Going on a proper beach vacation (without him) and paying for it in cash. Moving to a small rental house of my own. I didn’t necessarily see myself on a clear trajectory at the time. I felt I was constantly pushing away from a very rough period in my life and recovering from the disaster that was my divorce. I still thought of myself as… temporarily non-broke. I knew I wouldn’t feel any kind of peace of mind until some later point, not one that I could imagine, but probably something like a hundred thousand dollars of savings, that or annual income. Why would I ever stop what I was doing when I felt the dark alternative in my bones? When my boyfriend of nearly three years called and suggested that we have a financial planning meeting together, I was intrigued and excited. Sure, sounds great! He came over to my mini-house. I loved that place! It was the first time in my life that I felt really proud of where I lived, the tiniest house in a safe, quiet, and upscale neighborhood. (It was really more like a servant’s quarters, to be honest, a granny unit on the same lot as a house that was 4x larger). I had built all my IKEA furniture myself, bought and paid for it all in cash, and although I was renting, my place was nicer than my boyfriend’s. The financial planning meeting wasn’t too different from the New Year’s planning I had invited him to do with me for the last three years. I think that process opened the door for this. We had already had some practice being open and honest with each other, we’d already seen some of our plans work out, and we had been talking about money since before we started dating. He worked the calculator and I wrote everything down on ordinary lined notebook paper. Most of our discussion was setting the parameters for what would go into the plan. We started with the assumption that neither of us would ever get a raise, a promotion, a bonus, or a windfall of any kind. That way, any successes of this nature would come as pleasant surprises, not baseline requirements. We each have our own page. Our names are right at the top. We’re set up slightly differently, because at the time our retirement savings were structured differently and we had different expenses. I supposedly had a pension and a deferred savings account, while he had a traditional 401(k). He was still paying child support, alimony, and a note on his truck. (I had already gone car-free by then). It took me a while to reinterpret the math, because almost everything I had written out for both of us was arithmetic, not notes or dictation. We were estimating our retirement contributions and savings. In his case, we were forecasting how much more he could save after he paid off his truck and no longer owed alimony or child support. What we failed to anticipate was a couple of layoffs, major moves, and surprise expenses. *gulp* We also didn’t include consumer debt or my last student loan. Oh, and, um, we didn’t include me quitting my day job a year later. *nervous laughter* Or the wedding, since the entire topic of marriage had not come up yet... Ten years is a pretty long time for anyone. It’s quite a long time indeed in the life of a love relationship. My first marriage was over and done in a three-year span. It was a little nuts for us to be forecasting this far, and we knew it at the time. WHO KNEW what the future would bring??? Trust, love, and optimism, that’s what it brought, along with the usual share of disruption, dread, and calamity. When both of our ten-year financial forecasts were finished, a full page for each of us, we sat back and looked at each other. Wow! That was actually fun! Just a couple of months later, he proposed, his decision already made. He chose the one who likes to crunch numbers and talk about money, the one who is a careful saver, who reads personal finance manuals and manages her own investments. The one who beat the market in 2008. He chose me. I chose him right back. I could choose freely because I didn’t need him, I wanted him. I was doing fine on my own. It just so happened that we liked it better when we were together. How did it turn out? After ten years: roughly two thousand dollars ahead of forecast. That’s a 0.4% win, pretty much as close as one could get. How about that? Not only do we still like each other and find each other attractive, we just found vindication of our decisions from a decade ago buried in a stack of papers. Our methods apparently worked. Now it’s probably time to put together a new ten-year plan, since the old one just expired. We can add in the perspective we’ve gained over the past decade, with the assumption that the next ten years will probably include a long recession and the firm knowledge that we can’t expect a single thing in our lives to stay the same. Well, except for our ability to have rational discussions together about our plans. That part we get to keep. Comments are closed.

|

AuthorI've been working with chronic disorganization, squalor, and hoarding for over 20 years. I'm also a marathon runner who was diagnosed with fibromyalgia and thyroid disease 17 years ago. This website uses marketing and tracking technologies. Opting out of this will opt you out of all cookies, except for those needed to run the website. Note that some products may not work as well without tracking cookies. Opt Out of CookiesArchives

January 2022

Categories

All

|

RSS Feed

RSS Feed