|

This is a story of a stack of money that could have disappeared, but didn’t. Granted, it might be more interesting to talk about that money if it did go bye-bye. Everyone can identify with that, right? There’s more value in the story that not everyone knows, the story of how losses can be avoided through strategy and careful study. If you’re tired of being broke, the first step is to avoid losing what you already have or getting into further debt. It can be done!

It’s IRA time. Before your eyes glaze over, let me quickly explain what that means and how it works.

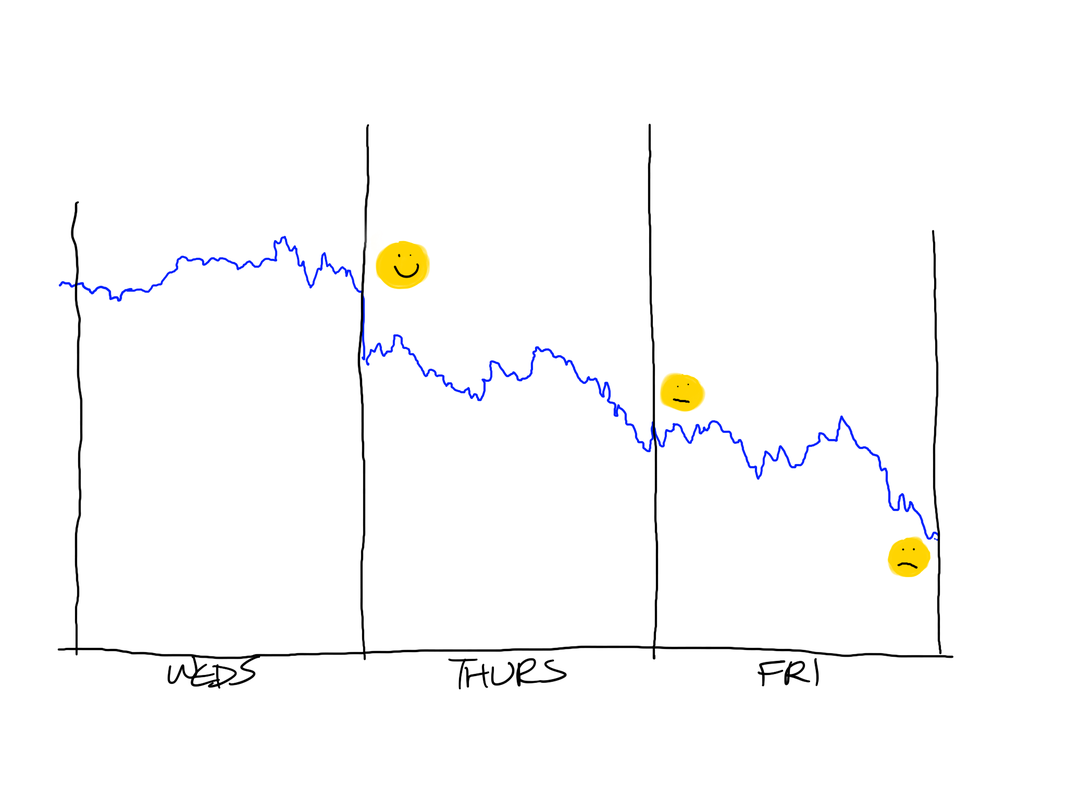

Not too confusing, right? I wish I had paid more attention to this sort of thing when I first started out, because I definitely would have found a way to come up with that money, and it would have turned into tens of thousands of dollars by now. I was saving $50 a week even when my take-home pay was $220. This is money I don’t have because I was too bored to read basic instructions or spend 20 minutes setting up an account. ANYWAY... It’s close to tax time, and my husband reminded me that we needed to fund our IRAs so we can get the deduction. We are extremely serious about saving money, so much so that we live in a studio apartment and we don’t own a car. All we had to do was to transfer the money from our regular bank to E*TRADE, where we keep our retirement munneh. Takes like 10 minutes. We’ve been talking about this pretty much for a year, so funding our IRAs was not a decision point. We didn’t need to discuss what we were going to do; we just did it. This is a massive, huge help. Taking action on something that you understand, when you feel confident that you know what to do, is just exactly as easy as ordering a pizza. Maybe even more so! Our position is subjective. It’s a matter of personal opinion. It’s a policy decision that we’ve made independently, based on what we think about current events, the economy, future trends, planetary alignments, or whatever. Lots of other people can and do make different decisions based on their own personal opinions and positions. My husband and I both like pineapple on our pizza, while recognizing that lots of other people don’t, and that’s fine. The truth is that those people are wrong, pineapple on pizza is delectable, and it always will be. The truth about investments is that one position may pay off very well in one year, and not pay off in a different year, because conditions change all the time. The main risk is in saving nothing. Living on 100% of what you make, or living off credit cards because you actually spend more than you earn. I’ve been there, I get it. Back to the story. I now had $5500 in cash in my IRA account. Nice, flat green American dollars. Those dollars belong to Old Me. Future Me, playing with her Future Phone, riding around town in her flying car and wearing a metallic body stocking. You’re welcome, Future Me! What I’m supposed to do is to then use my nice, carefully saved $5500 and buy shares of various stocks or funds or bonds (*snort*) with it. As that money sits in cash, it is not technically an investment. It won’t earn a single penny in interest, no matter how long I leave it there. A lot of people do this on accident, not realizing that their IRA account is basically just an electronic envelope to hold their money. (Or collect dividends, which I think of as “money babies.”) Okay, so. Here is where it starts to get good. My hubby and I had both already decided to leave our 2017 IRA contributions in cash, because we anticipate a significant market drop. We have our own separate investment accounts, and we make our own decisions, because we earned that money from our own careers and we have our own strategies. This is a type of diversification. Cognitive diversification! We do our own research and our own analysis, and we trade notes. As it turns out, my investments outperformed his last year (heh heh heh) and sometimes he buys into some of the same stuff that I do. We high-fived after transferring the money. THE VERY NEXT MORNING The market tanked! My 5500 nice flat green American dollars are still sitting in my cash account, untouched by the ravages of a 734-point market drop. (Followed by ANOTHER drop of 425 points the following day!) If I had bought shares of anything off my shopping list, they would have been worth less later that same day. I would have lost a bunch of my IRA money within just HOURS of “investing” it. Not sure if I would have cried or punched a hole in the wall, but... Instead, I laughed. I laughed because this time I saw it coming. I didn’t know it would happen that fast, but I was stone-cold certain that in “the very near future” my shares would be worth less than they are now. In fact the value of my investment portfolio did drop over $1000 that day, but that’s okay because it’s still worth more than it was when I started. I also believe it will be worth more in three years than it is today. More importantly, I believe it will be worth more in 25 years, when Future Me comes to claim it. I’m not good at math - if you don’t believe me, come out to lunch with me and watch how long it takes me to calculate the tip. If someone like me, someone who started out flat broke, with poor arithmetic skills, can learn how to invest, then probably anyone can. The main thing is that you have to take the needs of Old You as seriously as you take the needs of Today You. That tends to make you careful and attentive. If you don’t have an IRA account set up, call someone at your bank, or if you hate making business calls as much as I do, you can probably do it on their website. If you want to get into investing for the first time, hang onto that money. Then start watching the headlines. When you start to see panic about record drops in the stock market, find a nice index fund and put your money into it. Pretend it isn’t there until this time next year. In the meantime, see if you can find a way to put aside $100 a week, or $20 a week, or $5 a week, or even $1 a week. Future You is going to thank you for it. Comments are closed.

|

AuthorI've been working with chronic disorganization, squalor, and hoarding for over 20 years. I'm also a marathon runner who was diagnosed with fibromyalgia and thyroid disease 17 years ago. This website uses marketing and tracking technologies. Opting out of this will opt you out of all cookies, except for those needed to run the website. Note that some products may not work as well without tracking cookies. Opt Out of CookiesArchives

January 2022

Categories

All

|

RSS Feed

RSS Feed