|

What do you do when you get diametrically opposed advice from two sources you respect? In this case, I’m examining an ongoing debate between Suze Orman and the FIRE (Financial Independence, Retire Early) community.

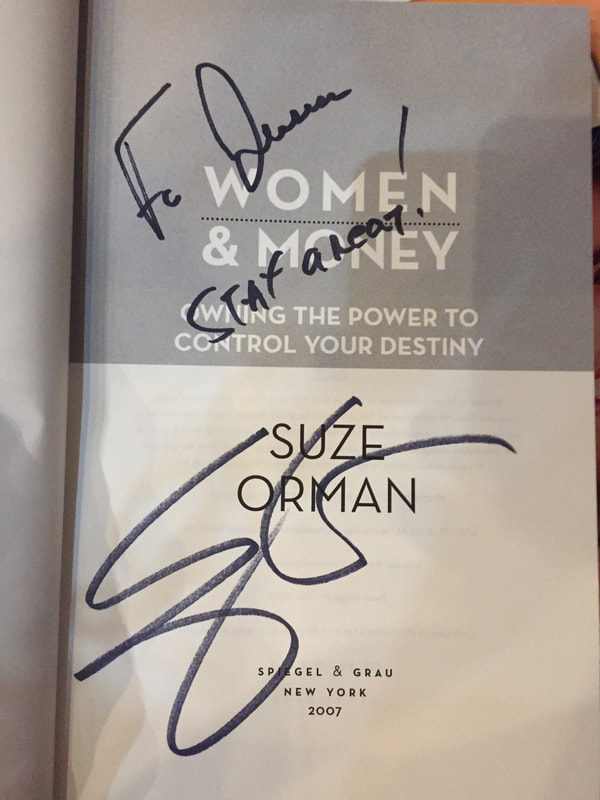

Think for yourself, I say, although it’s also good to know when you lack the relevant credentials or expertise. Ultimately you’re responsible for your own actions. You can find mutually exclusive advice in any area. What workout should you do? Is chocolate/wine/coffee good for you or not? Should you use Comic Sans on your resume? How should you allocate your investments? Dithering can be an excuse for maintaining the status quo, for neglecting to take any action. Being confused is not a good reason to abdicate responsibility for your life. Keep reading, keep asking questions, keep checking sources. The main tenet of the FIRE community is that by living frugally and investing carefully, an average family can become financially independent. The basic numbers that we toss around are a 4% annual withdrawal on a nest egg of $2 million, resulting in an annual income of $80,000. Suze Orman says that this is disastrous advice, that it will cause young families to quit working decades too soon and leave them defenseless against inflation, disability, caretaking responsibilities, taxes, and other unforeseen cataclysmic expenses. Keep going, she says, and if you want to quit when you have $5 or $10 million, then maybe. Where am I on this? I think both sides are right, both are wrong, both are leaning at least a little on the arts of rhetoric, and that exposure to more of both sides should be motivational and supportive for most readers. Suze Orman saved me from poverty. I’ve read all her books, paid to see her on tour, and met her in person. Her message that “if a waitress like me can become wealthy after growing up in poverty, then anyone can” was completely unique in my experience. She personally, she herself, is the reason I’m debt-free, the reason I paid cash for my wedding. I can’t say enough good things about how gracious and brilliant she is and how much I value her legacy. One hundred million, why not? If you say so, Suze. Save a seat for me, I’m going as fast as I can. On the other hand, it was Mr. Money Mustache who caught my husband’s attention. We’d talked quite a bit about money and frugality and Your Money or Your Life. It wasn’t until he heard MMM speak and saw THE SPREADSHEET that the real possibility of financial independence clicked into place for him. He caught FIRE. We radically changed our lifestyle almost overnight. Two years and a couple pay raises later, we had paid off my student loan and were saving 40% of our income. Most people probably start out in a similar mindset. We “know” but we don’t ACT because common knowledge is not common action. Information is not motivation. We hear “oh, save money save money” and we grunt and move on, the same as we do when we think about drinking more water or going to bed earlier. It takes the lightning bolt of a clear and personal visualization to make it feel real. I read Suze and thought, “if a waitress, then an office temp.” My husband heard Mr. Money Mustache and thought, “if one engineer and a spreadsheet, then another engineer.” Suze Orman became who she is one step at a time. She seized initiative and took charge of her own life. The further she went, the stronger she became, and the more agency she developed, the richer she got. That approach works. The young families in the FIRE community who have retired early did it one step, one conversation at a time. They learned basic personal finance and frugality techniques one at a time. They talked it out and tugged each other forward. That process doesn’t stop. The more you learn about money, the more you build your financial base. The more stable you feel about your finances, the more curious you become about how much more you could do if you try. The more you focus on financial independence, the more opportunities and possibilities you see. It’s also true that most people are, well, kinda delusional about how much they’re saving, how much their earning power will increase, and how long they’ll stay healthy. Likewise, it’s true that people in the financial services industry have a responsibility to make people nervous so they’ll be more likely to prepare themselves for disaster. That’s why everyone in the conversation is both right and wrong. My personal plan is based on the assumption that I’ll live to be quite, quite old and that for the last several years, I’ll also be frail and isolated. If I imagine Old Me at 85, childless, perhaps widowed, and reliant on others who only come over for pay, I must think, “Old Me sure would appreciate more money. Let me send her a check.” If I imagine Old Me at 85, a wealthy spitfire with tons of friends of all ages, I grin and start shopping for lavender wigs. I don’t see the point of “retiring early” at all, actually. Retiring implies a withdrawal from life. My desire is to open a gym when I turn sixty, so I can stay active and inspire young women in their twenties to do the same. I see a vision of Old Me teaching classes and workshops, writing books and traveling around the world to give talks. Maybe it will never happen, but it gives me a good reason to keep stretching and trying to do the splits. Likewise, my husband is an aerospace engineer. One of the major perks of his job is that he’s called upon to mentor students, interns, and new engineers. He loves it. He’s doing what he’s wanted to do all his life, and he’s good at it, so why would he ever quit? There are “retired” engineers at his work in their eighties who still come into the office because they can’t stay away. We have a shared vision of contributing to the world far into old age, not because we’re afraid and broke, but because we still have something important and valuable to offer. We save 40% of our income because financial security is so compelling in its own right. There are no good reasons to live on the financial razor’s edge. What’s the answer? Save two million or five million? Retire early or retire late? Who do you listen to? I say to save the first two million and then check back in. Saving even one thousand dollars is more than most Americans have done. Don’t let an internet argument distract from the core goal. Everyone agrees that financial stability is worth your focused attention. Comments are closed.

|

AuthorI've been working with chronic disorganization, squalor, and hoarding for over 20 years. I'm also a marathon runner who was diagnosed with fibromyalgia and thyroid disease 17 years ago. This website uses marketing and tracking technologies. Opting out of this will opt you out of all cookies, except for those needed to run the website. Note that some products may not work as well without tracking cookies. Opt Out of CookiesArchives

January 2022

Categories

All

|

RSS Feed

RSS Feed