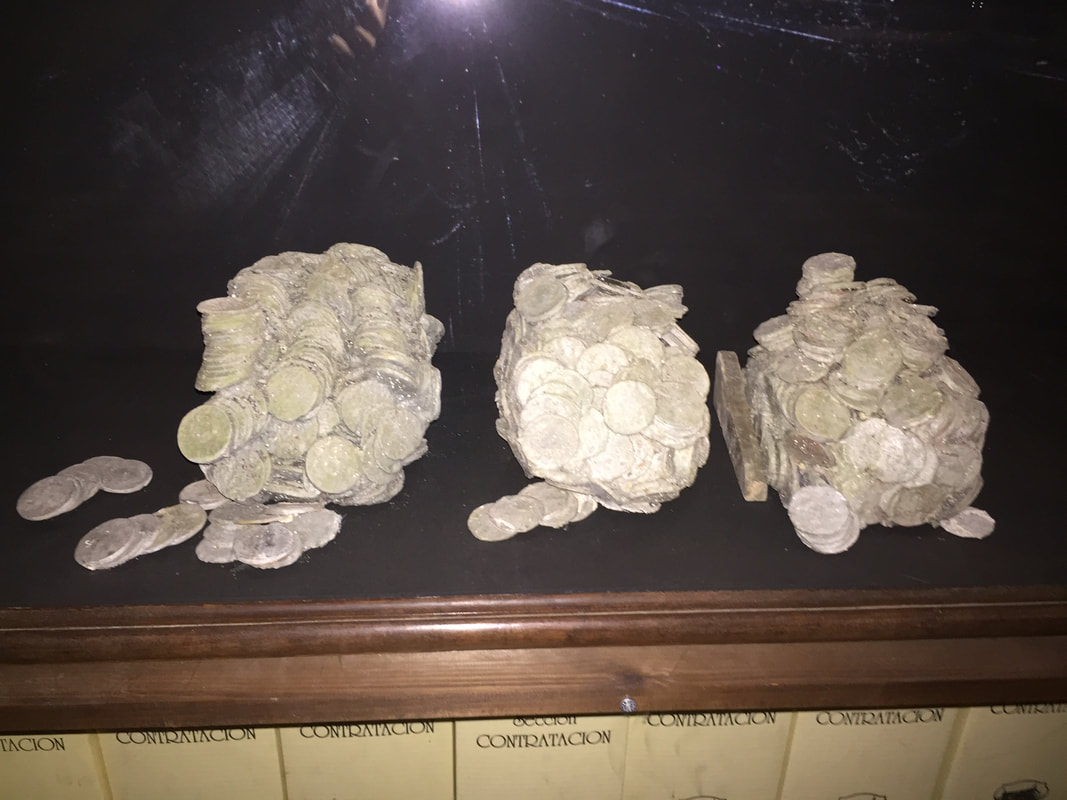

Sunken Spanish treasure. It was under water. #seewhatIdidthere Sunken Spanish treasure. It was under water. #seewhatIdidthere Money is so abstract. I don’t know about you, but I can go months without needing to use cash. Almost all of our bills are set up on auto-pay, and all our sources of income are deposited directly into our accounts. Our finances are set up in such a way that we don’t really have to pay them any mind; we can go about our business without knowing how much we have in our accounts. Most people probably do something similar. As modern people, we don’t have to carry around little pouches full of hammered coins and hack silver. Money is energy, and it shows up as digital representations of numerals that we look at on various screens. If we’re still getting paper account statements, many of us are letting them stack up, still glued inside their envelopes. Deciding to go debt-free means pulling money out of the world of the abstract and trying to make it more concrete, more real. Visualizing debt in any way that makes sense is one way to begin to fight it. A drawing of a thermometer is a common symbol for fundraising. That’s one way to do it. Calculate the amount you owe, draw a thermometer, and color it in as you pay it off. I don’t know, though. As a constantly chilly person, I love the idea of the money thermometer gradually warming up, but that visual might not do much for others. The other problem with this idea is that debt is a moving target. Between interest payments, finance charges, fees, service charges, and every other category of expenditure that exists, the balance can go up even as your latest payment clears the bank. I used to have a little image inside my purse. I clipped it out of a magazine and taped it inside the top of my purse, which was shaped like a little trunk. The picture was of a man opening his wallet, hair standing on end, eyes bugging out, mouth dropping open in alarm, while all of his paper money grew wings and flew out of his wallet. I chose the picture because I wanted to associate spending money with feeling horrified. There were indeed moments when I considered buying something, opened my purse, saw the image of the flying money, and put the item back. This dissuaded me from a few purchases, but in itself it didn’t help me to increase my income or to become debt-free. It didn’t help me to replace my narrative about money with anything positive or constructive. I paid off one of my student loans six years early. It was a Perkins loan. I chose it because it was the next-smallest debt on my list; I’d spent the past couple of years steadily paying off personal loans and credit card balances, and I had no consumer debt left. This was after I sold my car. I visualized the Perkins loan as a man named Perkins. Perkins was a pencil-neck geek, a sniveling Poindexter whose sole goal in life was to triple-check his ledger and look for extra pennies to add to my account balance. Bureaucracy personified. “Take that, Perkins!” I would say to myself as I made extra payments. Up to that time, my primary visualization came in the form of a spreadsheet. I had a line item for each of my bank accounts, credit cards, personal loans, car loan, everything. There was a page for my expenses. I would track when my bills were due along with when my paychecks would come in, figuring each time one of those extra-paycheck months rolled around. I checked the spreadsheet every day, updating the balances. This habit helped me catch a few bank errors and discrepancies in my bills. Zeroing out the balance on a loan that I had finally retired was a great way of reminding myself that I had made progress. I was gaining ground in this battle. Territory on a Risk board. Blasting holes in a giant asteroid that’s hurtling toward your roof. Plugging holes in a little rowboat. Throwing bundles of cash over your shoulder at mobsters in hot pursuit. Racing from one destination (Debt City) to another (Financial Independence Island). Maybe you can visualize your creditors as various movie monsters, and you have to neutralize them before they succeed in breaking through your boarded-up windows. Debt is ants crawling on a pie. You don’t really want to be eating that pie; it’s awfully hard to enjoy something that’s supposed to be sweet when you know it’s contaminated. (The pie is your cash flow). That’s one thing that ants and other vermin have in common with debt. They increase on you and they start taking over the minute you relax vigilance. Debt is a shackle on your ankle. The bigger the debt, the bigger the ball that’s attached to the chain, the more it slows you down as you drag your leg. Debt is leaving the window open during a blizzard. Each separate source of debt is another window open to the snow. Debt is a leaky roof. Eventually the drips will start causing water damage to your carpets, your flooring, your furniture, your walls. Eventually there’s black mold everywhere and you’re ankle-deep in a puddle. Debt is the selfish Past Self, stealing from you, picking your pocket and laughing at you. Debt is Past Self, taking your vacation money and blowing it on pizza. Past Self, throwing tantrums and demanding to be placated with toys and treats. Past Self, easily bored and uninterested in budgets or bank statements or quarterly reports or planning for any kind of future. Past Self, this is your fault! Visualizing debt should bring up feelings of anger, frustration, and determination. This is where the drive to demolish it comes from. Sadness, guilt, shame, or futility aren’t going to get the job done here. Debt is, very simply, a cultural problem that affects most people at least temporarily. It’s not a character flaw, it’s just a circumstance that can be changed. Visualize it as something that you find so annoying that you take it personally: litter, a bad parking job, cigarette butts, graffiti, the cell phone ringing in the movie theater. Anchor your feelings of annoyance to your debt in whatever way you can. Let it tickle your brain. Make it a target. Start seeing your debt as a specific, individual villain that you can defeat. When you’ve pummeled it into submission, you can then start the fun of visualizing wealth. Comments are closed.

|

AuthorI've been working with chronic disorganization, squalor, and hoarding for over 20 years. I'm also a marathon runner who was diagnosed with fibromyalgia and thyroid disease 17 years ago. This website uses marketing and tracking technologies. Opting out of this will opt you out of all cookies, except for those needed to run the website. Note that some products may not work as well without tracking cookies. Opt Out of CookiesArchives

January 2022

Categories

All

|

RSS Feed

RSS Feed